The accounts receivable (AR) and accounts payable (AP) rules in the Balance Sheet section of your forecast handle the opening balances for receipts and payments. To ensure the opening balances are reflected in the Cashflow Forecast correctly, you should review the settings for these rules.

The opening balances for your Accounts Receivable and Accounts Payable accounts flow through to the cashflow automatically. In these rules, there are two settings to control how the cash movements appear.

This is the default setting, and will use the timing of payments rules attached to the accounts in the Profit and Loss.

Note: By default, your Accounts Receivable rule uses the same percentage breakdown as the REV.TRA rule, and the Accounts Payable rule uses the same percentage breakdown as the EXP.COS and EXP rules.

This option is not suitable if you set your income and expenses as payable in the current month.

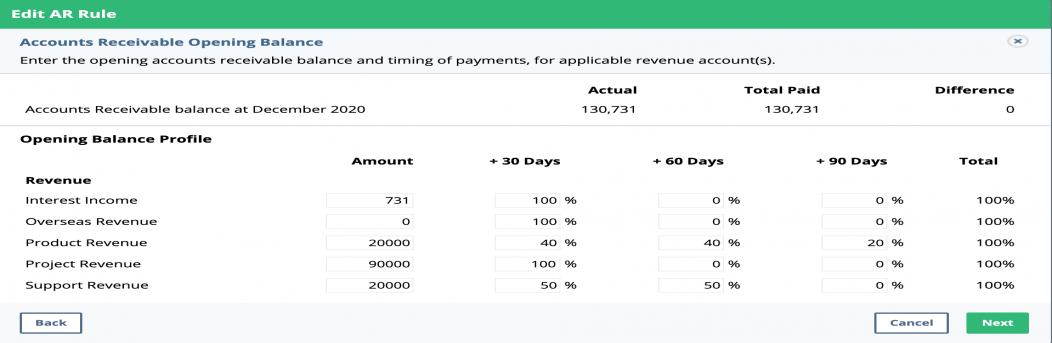

When you select this option, you can determine the timing of payments for the opening accounts receivable/payable balances. This acts as the manual override for the opening balances, so that you can record different payment timings to those specified on your income and expense accounts.

Note: If you update your actuals from your data source each month, then you will need to adjust these amounts so that the Actual amount and the Total Paid amount are the same.

If you notice a negative Accounts Receivable or Accounts Payable balance in your data grid, this can be due to the profile within the rule.

To avoid this, please use the second profile in the AR/AP rule, I want to enter the timing of payments for the opening accounts receivable/payable balance. You can then apportion the actual outstanding receivables/payables for the opening balance.